Check Our New Mortgage Tool

Find out your chances of getting loan in 1 minute. No credit check.

Get started

Why Choose LBC Mortgage Over a Traditional Bank?

You deserve a truly personalized mortgage experience, something traditional banks don’t provide. They typically treat you like any other number on a spreadsheet, while LBC Mortgage sees and honors the story behind the numbers.

We’re committed to creating solutions that align with your unique goals and needs.

| Services | Big Banks / Online Lenders | |

| No Administrative Fees | ||

| Access to 100+ lenders | ||

| In-house underwriting | ||

| A one-stop solution | ||

| Personalized approach | ||

| Minimum paperwork | ||

| Underwritten Pre-appovals | ||

| Bridge Loans |

Explore Our Loan Programs

Find the Right Fit for Your Needs

Get $5,000 in Perks once we close

Get Your RewardsHow We Simplify Your Loan Process

From consultation to closing, we make the mortgage process easy and stress-free.

-

Schedule a Free Consultation Today

No sales pressure, just expert advice to help you and find right option for your needs.

-

We Analyze Options from 100+ Lenders

Our team compares offers and finds the perfect solution for your needs.

-

We Handle All the Paperwork

We take care of all documentation and guide you through the closing process.

-

Your Deal Is Closed, Successfully

Congratulations! You've successfully secured your loan and are ready for the next step.

Get Your Free Consultation

Speak with a mortgage expert — no sales talk, no pressure, just the details you need to take a smart decision.

Schedule a ConsultationTop-Rated Mortgage Broker

What can you expect from the LBC Mortgage? Extraordinary, stress-free service that saves you time, energy, and money — all delivered seamlessly by our team of highly experienced professionals. Since 2008, we’ve closed over $1 billion in loans.

Meet the TeamSee Why People Choose Us

Take Advantage of Our Tools

-

Home Value Report

Get a free home value report that gives you the tools you need to manage your home like the powerful investment it is.

Get Started -

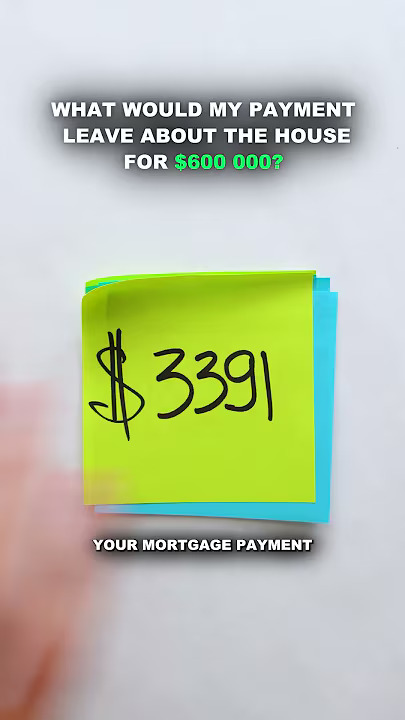

Mortgage Calculator

Our Mortgage Calculator helps you estimate your monthly payments based on loan amount, interest rate, and loan term.

Let’s Calculate -

Loan Limits

Check what limits are allowed in your county.

Loan Limits

Your Mortgage Roadmap – Free Access

Learn best practices and strategies to gain invaluable insight from experts in the field. Become a savvy pro with up-to-date knowledge on real estate trends that will help you succeed!

Get Free CoursePersonalized Services for Homebuyers

Tailored Mortgage Solutions Across Ten States

Whether you’re a first-time buyer or looking to refinance, LBC Mortgage provides personalized home loan solutions across ten states. Our team of licensed mortgage professionals serves communities in California, Florida, Illinois, Colorado, Washington, Texas, North Carolina, South Carolina, Pennsylvania and Oregon offering expert guidance throughout your home financing journey. Additionally, if you’re seeking financing for an investment property, we offer nationwide services to meet your needs. We’re committed to making the mortgage process straightforward while helping you achieve your homeownership goals.

Why Choose LBC Mortgage?

LBC Mortgage takes a more personal approach than conventional lenders, taking time to understand your unique circumstances. Our customized mortgage solutions are designed to match your individual financial profile and goals. From first-time buyers to experienced investors and business owners, we have the knowledge and tools to find your ideal mortgage option. Our dedicated team works tirelessly to ensure you not only get competitive rates but also receive the support and guidance you deserve throughout the lending process.

Multilingual Expertise

Our diverse team breaks down language barriers by offering mortgage services in English, Spanish, Russian, Ukrainian and Hebrew. This multilingual approach ensures clear communication and helps you feel at ease while discussing your home financing needs. Whether you prefer to speak in your native language or English, our knowledgeable professionals will guide you through each step with clarity and cultural understanding, making your mortgage journey smoother and more comfortable.

| Services | | Banks |

| No Administrative Fees | ||

| Access to 100+ lenders | ||

| In-house underwriting | ||

| A one-stop solution | ||

| Personalized approach | ||

| Minimum paperwork | ||

| Underwritten Pre-appovals | ||

| Bridge Loans |

Mortgage Broker VS. Traditional Banks

When it comes to securing a mortgage, LBC Mortgage stands out as a superior alternative to traditional banks. Unlike banks, which often treat clients as just another application, LBC Mortgage provides a personalized experience tailored to each client’s unique needs. With no broker fees and minimal paperwork, our process is streamlined to save you time and money. Our one-stop solution means you’ll receive comprehensive support throughout your home-buying journey, ensuring a seamless and hassle-free experience.

Another major advantage is our access to a network of over 100 lenders, giving you unmatched flexibility to find the best rates and terms. Traditional banks are often limited in their options, while LBC Mortgage provides a wider range of loan programs to meet your specific requirements. Whether you’re a first-time homebuyer or an experienced investor, we’re here to offer solutions designed to help you achieve your goals with ease and confidence.

Our Services Include

-

Customized Loan Options

Whether you’re looking for FHA, Сonventional, NON-QM, Portfolio, Hard Money Loan, we tailor solutions to meet your needs.

-

Credit Score Improvement Guidance

We help you boost your credit profile to secure better rates.

-

Real Estate Market Insights

Stay informed with updates on housing trends and opportunities.

-

Minimal Paperwork

We handle the documentation so you can focus on what matters most.

Get Started Today

Your journey to homeownership starts here. With our expertise and commitment to customer service, we make the process straightforward and stress-free. Take the first step by entering your email to schedule a free consultation.

Get StartedWhy Clients Love LBC Mortgage

-

Personalized Attention

From start to finish, a dedicated manager will guide you, ensuring your questions are answered promptly.

-

Exceptional Support

We simplify complex processes and ensure you have a hassle-free experience.

-

Multilingual Team

We speak different languages to ensure you feel understood and valued.

Get in Touch

Whether you’re buying a home or are ready to refinance, our experts are here to help.

All You Need to Know About Mortgages

View More Articles

How the New Credit Scoring Models Can Help Californians Qualify for a Mortgage in 2026

How Trump’s $200B Mortgage Bond Purchase Could Lower California Home Loan Costs

Mortgage Loans for Self-Employed Individuals in California

Frequently Asked Questions

General Questions

1. How do I get pre-approved for a mortgage?

To get pre-approved, we’ll start with a quick 10-minute consultation to understand your situation. During this call, we’ll tell you what documents we need to review your application. Once we have everything, we usually provide pre-approval the same day. Ready to get started? Schedule your consultation now!

2. What makes LBC Mortgage different from other lenders?

At LBC Mortgage, we focus on personal service and finding the right solutions for you. We know the local market well and offer a variety of mortgage products, including options for self-employed individuals and newcomers. We’re here to guide you through the entire home-buying process.

3. Can I qualify for a mortgage if I’m self-employed?

Yes! We specialize in helping self-employed individuals get loans. Our team will work with you to understand your income and find the best mortgage option. We can often use alternative documentation to make it easier for you. Want to learn more? Contact us today!

4. Can I get a mortgage without showing my taxes?

Yes, some mortgage programs don’t require tax returns. For example, the DSCR (Debt Service Coverage Ratio) loan allows for alternative documentation, which is helpful for self-employed people or investors. Want to see if you qualify? Reach out for a consultation!

5. What should I do if my credit score isn’t perfect?

Don’t worry! Many of our clients have credit scores that need improvement. We can give you tips on how to boost your credit and connect you with helpful resources. Our goal is to find the right loan for you, even if your credit needs work. Interested in finding out more? Get in touch!

6. How long does the mortgage process usually take?

The timeline can vary, but once your application is complete and we have all the documents, we aim to close within 30 days. Our efficient process and dedicated team help keep things moving quickly. Want to know more about the steps? Contact us!

7. What happens if my loan application is denied?

If your application is denied, don’t worry—it’s not the end of the road. We’ll give you feedback on why it happened and guide you on what to do next to improve your chances for approval later. We believe in second chances and are here to help. Ready to explore your options? Contact us!

8. How do I choose the right mortgage product for me?

Choosing the right mortgage can feel overwhelming, but our team is here to help. We’ll take the time to understand your financial situation and goals before recommending the best options for you. We offer various choices, from conventional loans to hard money loans, ensuring you find the right fit. Want personalized advice? Schedule a consultation!

9. What are the benefits of working with LBC Mortgage?

When you work with LBC Mortgage, you’re not just getting a loan—you’re getting a partner in your home-buying journey. We provide personal service, a solid understanding of the local market, and access to many mortgage products. Our goal is to empower you with the knowledge and support you need to make informed choices. Ready to start? Let’s chat!

Refinancing

1. What is refinancing, and why should I consider it?

Refinancing means replacing your current mortgage with a new one, often to secure a lower interest rate, reduce monthly payments, or access cash for home improvements. It can help you save money over time or better align your mortgage with your financial goals. Want to see if refinancing is right for you? Contact us today!

2. How do I know if it’s the right time to refinance my mortgage?

The right time to refinance can depend on several factors, like current interest rates, your credit score, and how long you plan to stay in your home. If interest rates are lower than your current rate, or if you want to switch to a different loan type, it might be a good time to consider refinancing. Need help evaluating your situation? Schedule a consultation!

3. Can I refinance my mortgage without any equity?

Yes, some refinancing options, like FHA Streamline or VA loans, allow you to refinance even if you have little to no equity. However, your specific options will depend on your financial situation and the type of loan you currently have. Want to explore your options? Reach out to us!

4. What documents do I need to refinance my mortgage?

Typically, you’ll need to provide documents such as proof of income, bank statements, and information about your current mortgage. Our team will guide you through the documentation process to ensure a smooth experience. Ready to get started? Contact us for assistance!

5. How long does the refinancing process take?

The refinancing process can usually take 30 to 45 days, depending on your situation and how quickly we receive the necessary documents. Our team works efficiently to ensure your refinancing goes as smoothly and quickly as possible. Want to know more about what to expect? Get in touch!

6. Will refinancing affect my credit score?

Yes, refinancing can have a temporary impact on your credit score due to the credit inquiry and changes to your credit utilization. However, if you secure a better interest rate or payment terms, it could improve your financial situation in the long run. Have more questions about your credit? Contact us!

7. What are closing costs for refinancing, and how much should I expect to pay?

Closing costs for refinancing typically range from 2% to 5% of the loan amount. These costs can include appraisal fees, title insurance, and attorney fees. We can help you understand the costs involved and discuss options for rolling them into your new loan. Curious about your specific costs? Let’s talk!

8. Can I cash out when I refinance my mortgage?

Yes, cash-out refinancing allows you to access the equity in your home and use that cash for other purposes, such as home improvements, debt consolidation, or other expenses. It’s important to consider how this affects your overall financial situation. Want to explore cash-out options? Schedule a consultation!

9. What if I recently refinanced my mortgage — can I do it again?

Yes, you can refinance again even if you just did it recently, but it’s important to assess whether it makes financial sense. Consider factors like current rates, your financial goals, and the closing costs involved. Ready to evaluate your refinancing options? Contact us for more info!